Stories you may like

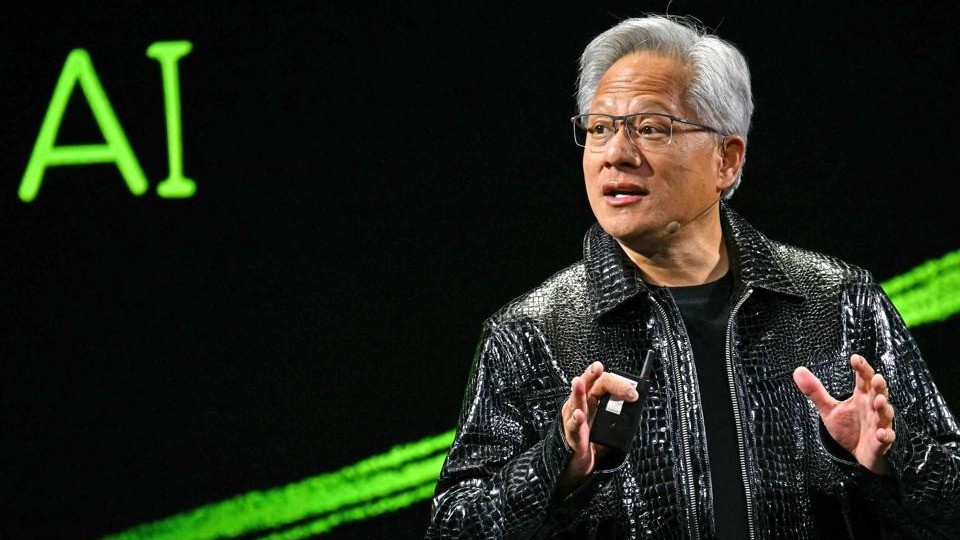

From Workflow-to-Wallet: The CEO’s Playbook for AI-Driven Profitable Growth

Every CEO faces the same fundamental challenge: translating massive operational investments into predictable, profitable growth that moves the stock price. We are inundated with dashboards, but few can draw a straight, data-backed line from an IT support ticket or a customer service case directly to their EPS.

This gap between operations and finance is no longer acceptable. It’s a drag on margins and a critical blind spot that allows nimbler competitors to win. The antidote is a new, AI-driven model that transforms your company's operational data from a cost center into a high-octane fuel for the GTM engine.

This "Workflow-to-Wallet" approach provides a playbook for engineering profitable growth. The strategy, exemplified by ServiceNow—a company delivering a rare "Rule of 54" performance (20%+ growth combined with a 32% FCF margin) —is built on three core disciplines.

Playbook Step 1: Forge a Unified Data Core

The separation between your GTM data (in Marketo or Salesforce) and your operational data (in service platforms) is the primary source of value leakage. The first step is to break these silos by creating a single source of truth, often in a unified data warehouse like Databricks.

This isn't just about analytics; it's about enrichment. When a prospect's marketing engagement is layered with real-time operational signals—such as their company opening multiple high-priority support tickets or their developers accessing specific API documentation—a simple "lead" transforms into a rich profile of urgent need. This creates a holistic view that is predictive, not just reflective.

Playbook Step 2: Weaponize AI with Operational Intelligence

With a unified data core, AI models become exponentially more powerful. Standard lead scoring is based on past behavior. An operationally-aware model predicts future need.

This system can automatically identify an account that is ripe for an upsell to a premium security offering because its own incident data shows a rising threat level. It can flag a customer for proactive engagement when product usage telemetry indicates potential churn risk. This is how leading firms focus their most expensive resources on the highest-probability opportunities, a key reason why 70% of customers can be systematically guided to increase their annual spend and gross renewal rates remain at a best-in-class 98-99%.

Playbook Step 3: Connect Workflow Efficiencies Directly to Financials

This is where the model moves from theory to tangible shareholder value. The "workflow" improvements must be measured and translated into the language of the CFO.

- The Workflow: AI-driven automation delivers a ~25% reduction in critical IT incidents and slashes mean-time-to-resolution by up to 70%.

- The Wallet: Fewer incidents and faster resolution times directly lower the cost of service, increase productivity, and improve customer retention—all of which are direct inputs to margin expansion. This operational excellence is a primary driver enabling the expansion of non-GAAP operating margins from ~30% toward the mid-30s.

This engine doesn't just protect revenue; it creates new streams. The demand for these embedded AI capabilities is explosive. Deals including ServiceNow’s "Now Assist" GenAI features jumped over 150% quarter-over-quarter , putting the product on a firm trajectory to become a ~$1 billion Annual Contract Value (ACV) business by 2026. This is the ultimate proof point: creating operational value so compelling, it becomes a premium, high-growth product in its own right.

The imperative for leaders is to stop viewing operations as a separate entity from the revenue engine. Your company's daily workflow data is one of its most valuable, yet untapped, assets. By unifying it, infusing it with AI, and connecting it directly to financial outcomes, you can build a formidable and lasting competitive moat.

User's Comments

No comments there.